|

|

Congrats, it’s amazing that you’re looking into the best personal finance books of all-time. That already tells me a lot about you!

Do you look at people who are uber-successful and wonder what their secret is? What do the richest people in America know that you don’t?

The truth is, the secret to success lies in educating yourself about money and modeling those around you who have achieved financial success. As Tony Robbins always says, “Success leaves clues.“

Look, you become what you study. The more time and energy you put into your financial education, the more savvy you will become.

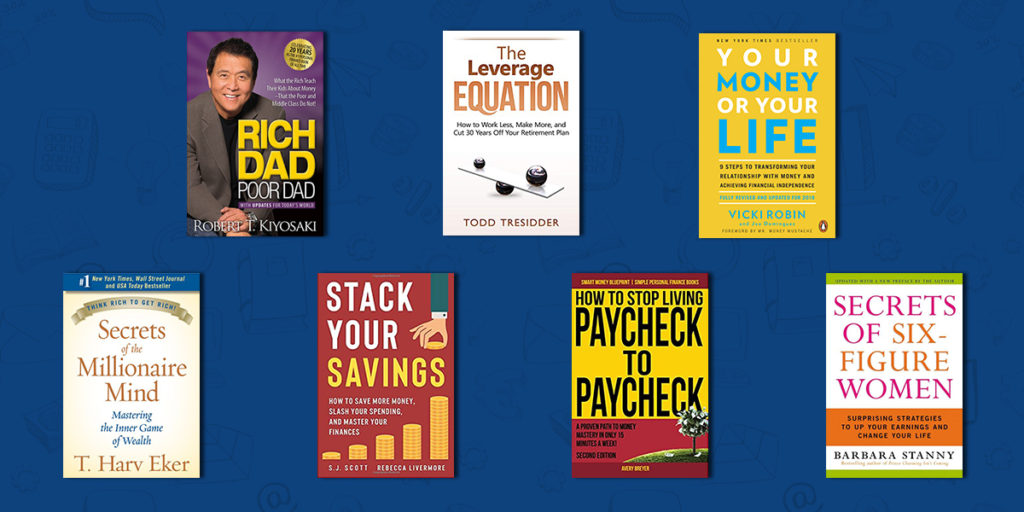

7 Best Personal Finance Books of All Time

Reading books on how to make, manage and invest money is critical to your financial future. Enjoy this roundup of the best personal finance books of all time.

1. Rich Dad, Poor Dad

Rich Dad Poor Dad by best-selling author, Robert Kiyosaki, is my favorite personal finance book. In it, Kiyosaki teaches the importance of getting your money to work for you, instead of you working for it.

Unfortunately, all too many people think they need to go to school, find a job with benefits, budget their money, pay their bills, and slowly save until they get near the end of life. They repeat this cycle day by day, month by month, year by year, but end up living on a fixed budget in retirement.

Robert is of the opinion that your money should work for you. Thus, he teaches that your number one goal should be to convert earned income (“active income”) into portfolio or investment money (“passive income”) as rapidly as possible.

That is, he teaches you how to convert money from your job into cash flow producing assets.

This is a skill that everyone must learn to achieve financial freedom.

If you’re really motivated, Kiyosaki’s book Rich Dad’s CASHFLOW Quadrant is also amazing.

2. The Leverage Equation

In his book The Leverage Equation: How to Work Less, Make More, and Cut 30 Years Off Your Retirement Plan, financial guru and former hedge fund manager Todd Tresidder teaches readers how to harness the power of all six different types of leverage.

This book will open your eyes and make you look at the way you approach your finances from an entirely new perspective. This alone earns it a spot as one of the best finance books of all time.

3. Your Money or Your Life

Originally published in 1992, Vicki Robin’s Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence was fully revised and updated in 2018.

One of the pivotal points in this book focuses on “making a dying” rather than “making a living.”

Rather than focusing purely on the numbers, this book compels you to look at the bigger picture.

Do you want to work for someone else for the rest of your life? Or do you want to take control and live your life the way you want? This book will show you how to do just that.

4. Secrets of the Millionaire Mind

You can spend all the time in the world learning the ins and outs of the technical side of finance, but if you don’t get your mindset right, you’ll never truly get ahead.

The premise of T. Harv Eker’s Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth is that your subconscious, also called your “money and success blueprint,” is what predicts whether you’ll live your life rich or poor.

The first half of this book explains how the money blueprint works, while the second half presents 17 thoughts that rich people have and poor people don’t.

Each point is followed by an action step that will help you change your mindset and increase your wealth in the real world. It’s these real-life action steps that make this one of the best books on getting rich.

5. Stack Your Savings

S.J. Scott’s Stack Your Savings How to Save More Money, Slash Your Spending, and Master Your Finances conquers tough questions like “Why do people carry so much debt?” and “Why is it so hard to change your spending habits?”

It goes on to show you how even the smallest of changes can help you drastically reduce your debt and increase your savings. If you’re looking for the perfect combination of learning about personal finances and changing your money mindset, this is it.

6. How to Stop Living Paycheck to Paycheck

You’ve probably heard the statistics that say that 40% of Americans don’t have enough savings to cover a $400 emergency expense. If you’re currently living paycheck to paycheck, you know just how stressful this can be.

Avery Breyer’s How to Stop Living Paycheck to Paycheck: A proven path to money mastery in only 15 minutes a week! (Second Edition) provides everything you need to know to dig your way out of this vicious cycle.

Also known as a “budgeting bible,” this book provides you with details like how to get out of debt, how to build up an emergency stash, and tips for avoiding the worst budgeting traps. If you’re ready to take control of your personal finances, this is a great first step.

7. Secrets of Six-Figure Women

More women than ever are finding success in the financial world, and, thanks to Barbara Stanny’s Secrets of Six-Figure Women: Surprising Strategies to Up Your Earnings and Change Your Life, there will likely be many more in the future.

Have you ever wondered how high-earning women achieve success? From addressing issues from conquering the under-earner mindset to dealing with fears and doubts, this book reveals their secrets and helps readers figure out their own path for creating similar results.

Finding a mentor who is willing to share their secrets of success can completely change your life. But, if you haven’t managed to do so yet, this just may be the next best thing.

Beyond the Best Personal Finance Books of All Time

Now that you’ve got a list of the best personal finance books of all time, you’re ready to take the first step towards taking care of your finances and growing wealth.

With the pandemic still going on, interest rates on the rise, and a potential recession ahead, I’d recommend that you browse the blog for more articles on financial freedom.

You’ll learn actionable strategies to help you achieve the life you deserve.

Are we connected yet on Instagram? If not, let’s make it happen so I can share in your world too. This will also give you access to bite-sized “Money Mentorship” videos that I release exclusively on IG.