|

|

I love the Rule of 72, because it lets you do quick math in your head to determine how quickly an investment can compound (i.e., double or triple in value) over time.

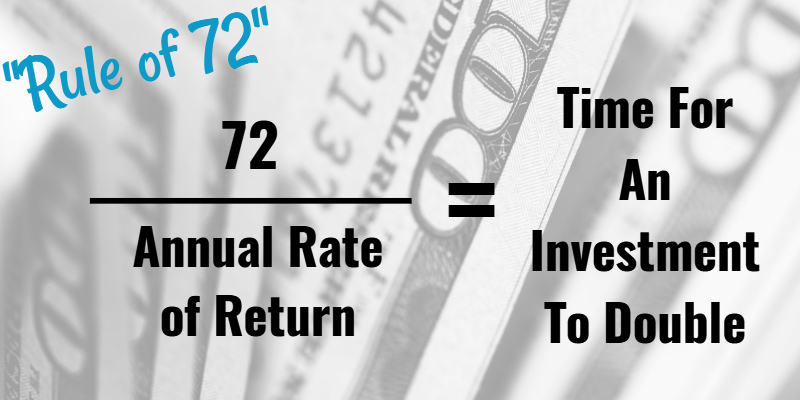

What is the Rule of 72? Simply put, the Rule of 72 is a quick way to estimate the number of years required to double the value of an investment at an annual rate of return.

This method was first featured in the Summa de Arithmetica of Luca Pacioli in 1494, which is impressive. Pacioli suggested using this method for calculating the estimated time of doubling investment.

View this post on Instagram

How Does the Rule of 72 of Work?

The Rule of 72 works by dividing the number 72 by the annual fixed interest rate of your investment to calculate the number of years required for your investment to double in value.

For example, if you have an investment with an annual interest rate of 10%, then divide 72 by 10 to get 7.2.

7.2 is the approximate number of years it would take you to double your initial investment, as shown below:

- 72 / 10% interest rate = ~7.2 years to double investment value

Or, if you have an investment with a yearly interest rate of 7%, then divide 72 by 7 to get 10.3.

10.3 is the approximate number of years it would take you to double your initial investment:

- 72 / 7% interest rate = ~10.3 years to double investment value

Rule of 72 Calculation

To understand why the Rule of 72 is helpful, here is the actual calculation that would be required to determine doubling time for an investment if we were to do it precisely. As you can see, it’s complex!

In this formula, T is equal to time to double while ln is equal to the natural log function. 72 is the constant number, r equals the interest rate per annual period and the ≃ stands for approximately equal to.

Thankfully, we can substitute this formula for a very close approximation by simply taking 72 divided by the annual interest rate. Phew.

The accuracy of the rule of 72 is relatively high, especially when it comes to low-interest rates. However, as interest rates increase, the accuracy of this method can slightly decrease.

The beautiful thing about the Rule of 72 is that it can also be used to assess:

- Inflation rates

- GDP growth

- Stock market returns

- Or just about anything that grows in value over time

There are plenty of applications for it, so it is a nice trick to learn!

How to Multiply Your Money (Fast)

How does the Rule of 72 pertain to wealth building?

Well, the time required to double an investment is one of the most important variables in expanding your net worth.

This is because a…

- 10% return will double your money in ~7.2 years (72 / 10 = ~7.2)

- 15% return will double your money in ~4.8 years (72 / 15 = ~4.8)

- 20% return will double your money in ~3.6 years (72 / 20 = ~3.6)

Better yet, this money will quadruple, then 8X, then 16X in value as those time periods stack up. Wow.

That, my friends, is why compounding matters. Your life span is limited, which is why you need your money to multiply quickly.

When you achieve a high interest rate, you can suddenly grow your money very rapidly while still being in the prime of your life.

This is powerful, and perhaps, why Albert Einstein called compounding the “8th wonder of the world.”

Rule of 72 vs. The Rule of 69.3

When it comes to calculating when your interest rates will double in time, using the rule of 72 is the easiest method there is.

This is because most interest rates are easily divisible by 72, allowing you to calculate it without the need of a calculator.

For example…

- 72 / 12% is 6 years

- 72 / 9% is 8 years

- 72 / 8% is 9 years

- 72 / 6% is 12 years

- 72 / 4% is 18 years

However, it is not the most accurate approximation.

If you prefer a more accurate calculation of when your investment will double, using the 69.3 will typically give you a closer time-frame of when this will happen. It also works better for calculating with daily or continuous compounding.

However, the downside for 69.3 is that it is not the most divisible or math friendly number. Unlike 72, which is divisible by 2, 4, 6, 8, 9, and 12, no numbers neatly divide into 69.3.

This tougher calculation means you’ll usually want a calculator handy if you prefer this approach.

When comparing both methods, using the Rule 72 is typically the best choice for a “quick-and-dirty” calculation, while the Rule of 69.3 can provide a more accurate result.

Getting a Loan? Assess If Your Interest Rates are Fair.

As discussed, knowing how to use the Rule of 72 is essential if you are considering a possible investment opportunity.

However, it will also let you know if you’re getting “price gouged” by a lender, such as an auto loan or a credit card company.

For example, if your credit card charges a 24% annual interest rate, the money you owe them will double every 3 years (72 / 24% = ~ 3 years). Yikes!

Hopefully, you’d be paying down some of your loan principal as you go (making this an approximate calculation and not precise), this rule shows that you’ll likely be chasing a never-ending cycle of debt.

Sadly, the interest you owe will be multiplying so quickly that you’ll have a hard time out-pacing your rapidly mounting debt.

Why Use the Rule of 72?

Many people invest their money in the hopes of having it multiply over some time. The faster it can grow, the better.

However, estimating how long doubling can take can be challenging, unless you’re in the know about the Rule of 72. With this simple “back of the napkin” trick, you can rapidly determine whether a potential investment is advantageous or not.

What questions do you have about the Rule of 72? Ask them in the comments below.