|

|

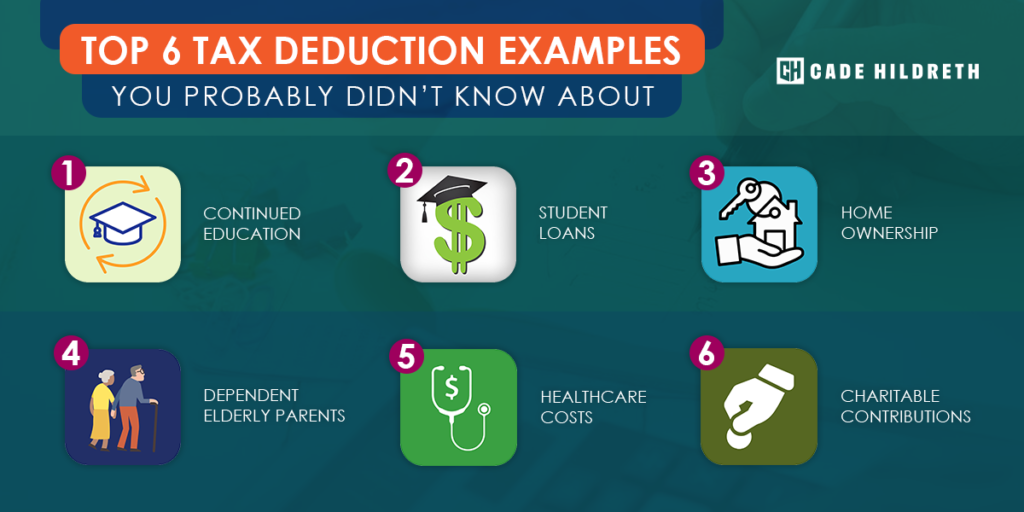

Are you trying to find concrete tax deduction examples? Do taxes make your head spin? You’re not alone in your confusion. Research shows that a staggering 52% of Americans find the tax-filing process frustrating and stressful.

As the adage goes, death and taxes are the only two certainties in this life. While most of us know the strategies associated with prolonging our lives (eating well, building sustainable friendships, moving our bodies regularly), many people flounder when it comes to managing their taxes.

That said, learning how to optimize your financial situation can save you some serious cash. In fact, taxes may be the single largest expense that you incur each year. Many Americans pay out more in taxes than they do to monthly housing costs in the form of rent or mortgage payments.

Let’s look into the top overlooked tax deduction examples and how they can save you serious money come tax time.

1. Tax Deductions for Continued Education

Do you want to go back to school? There’s an incentive for that!

Even if you are long past your college years, the tax deductions don’t stop the moment you graduate. The Lifetime Learning Credit can help offset some of the steep costs typically associated with higher education.

This credit applies to 20% of the first $10,000 of your out-of-pocket education expenses. The maximum tax credit is currently set to $2,000 per year.

To be eligible, your adjusted gross income (AGI) must be less than $58,000 when filing individually or $116,000 when filing a joint return.

The institution qualifies if it participates in federal student aid programs provided by the Department of Education. This often extends to both public and private universities in addition to vocational schools and some other freestanding educational institutions.

Qualifying expenses include:

- Tuition fees

- Textbooks, supplies, and equipment

- Activity and association fees

You cannot deduct costs associated with living arrangements, transportation costs, and medical expenses.

2. Tax Deductions for Student Loans

Student loans represent another great tax deduction example.

Are you paying off your student loans? While loans usually take a considerable chunk from your earnings, there is a small incentive.

The student loan interest deduction enables you to deduct up to $2,500 per year from your taxes. This isn’t a credit, but it does reduce your overall taxable income. Depending on how much money you make, this could push you into a lower tax bracket, which is advantageous.

To qualify, you need to meet the following requirements:

- You paid student loan interest during that tax year

- You were required to pay the interest (i.e., you can’t deduct the costs associated with paying interest for someone else)

- Your AGI is less than $65,000 when filing as a single or less than $135,000 when filing jointly.

Your lender will send you a 1098-E form if you owed more than $600 in student loan debt. This will help you calculate your overall interest.

3. Tax Deductions for Home Ownership

There are all kinds of deductions associated with real estate and home ownership. These deductions depend on the type of property you own and if you’re living in it or renting it out. Some examples of beneficial deductions include:

- Mortgage interest

- Depreciation on the property

- Selling your primary residence without paying taxes on the first $250,000 gain for a single filer or $500,000 gain for couples filing jointly.

Refinancing your mortgage also has benefits. You can deduct the points related to the life of the loan. With that in mind, you can deduct 1/30 of points per year if you’re locked into a conventional, 30-year mortgage.

When you eventually pay off the loan (whether you sell or refinance or pay it off altogether), you can deduct all the points you haven’t yet deducted.

Don’t forget that you can also deduct property tax costs each year. It is currently set to a $10,000 cap for state income, sales, and property taxes.

4. Tax Deductions for Dependent Elderly Parents

Most people know that you can write off children as dependents. However, care-taking for an elderly parent (who is unable to take care of themselves) may also save you some money.

To be eligible, the parent cannot earn or exceed the gross income test limit determined by the IRS each year. This figure may fluctuate. It does not typically include income from Social Security, though there are exceptions to this rule.

Moreover, to claim the dependent, you must have offered more than half of your parent’s care-taking support during the tax year. The support you provided must exceed your parent’s income by at least $1.

5. Tax Deductions for Healthcare Costs

Healthcare is a contentious topic in America. We’ve all heard horror stories of people receiving astronomical hospital bills. To date, medical-related issues are the leading factors associated with filing for bankruptcy.

Did you have a particularly expensive year in terms of your healthcare costs? If so, you might be able to generate a tax deduction.

However, to be eligible in 2019, the Affordable Healthcare Act requires that your medical expenses exceed 10% of your AGI. In other words, if you make $100,000, you need to have spent at least $10,000 on healthcare costs.

The following expenses are deductible:

- Preventative medical care and treatment

- Surgeries

- Mental health treatment

- Prescription medication

- Prescription appliances (hearing aids, glasses, insulin pumps, pacemakers)

- Travel costs associated with healthcare (parking fees, mileage on your car)

That said, you cannot deduct any reimbursements offered by your insurance or employer. You also cannot deduct the costs associated with non-prescription drugs or cosmetic surgery procedures.

6. Tax Deductions for Charitable Donations

Most people know that cash donations to charity can be tax-deductible if you follow the limits imposed by the IRS. Recipient charities must be a qualified organization per the IRS.

There are limits to how many charitable contributions you can deduct. In 2019, the limit is 60% of your Adjusted Gross Income (AGI). Furthermore, the standard deduction is currently $12,200 for single filers and $24,400 for couples filing jointly.

However, not all taxpayers know that you can also deduct noncash charitable gifts, such as donations made to Goodwill or the Salvation Army.

Donations of this type can include tangible donations, transportation costs, andmiscellaneous expenses.

When you drop of your donation, make sure to get a printed receipt, which you need to save for tax purposes. I’ve included an example of a recent receipt I received after making a Goodwill donation.

Then, use the app ItsDeductible to itemize your deductions, which will maximize their total value. Simply use the app to enter the item you donated and it will automatically calculate the item’s actual resale value, based on its current condition. It will also total all of your donations, giving you a simple “noncash charitable contribution” figure to enter at tax time.

By using this charitable donations, you could recover hundreds of dollars that you would otherwise owe to the IRS.

If you use TurboTax to file your taxes, the app will directly integrate with their software, making things even more seamless.

I should note that if you’ve made noncash charitable contributions with a value of more than $500, then you’ll want to use IRS Form 8283. This form allows individuals and corporations to file noncash charitable contributions in excess of $500.

Again, if you’re using a tax software like TurboTax, it’ll walk you step-by-step through the questions needed to complete this form. If this is your situation, good for you for being so charitable!

How to Optimize Tax Deductions

There are many tax deduction examples to consider when examining your finances. The trick isn’t to understand the whole tax code. Rather, it is about gradually learning more about the tax laws applicable to your situation each year.

Over time, this knowledge will position you to make increasingly smart decisions about how to allocate your time, money, and resources in order to optimally benefit from the IRS tax code.

I frequently remind people that if you were to learn about only one new tax deduction each year, the compounding effect of that action over 50 years would be profound.

To help people to best understand tax filing, I often liken it to playing a game of Monopoly. In both cases, you must follow the rules (in the case of taxes, it’s the law), but there are also clear strategies that you’ll want to learn and implement.

When playing Monopoly, you strategically buy up the Railroads, and if possible, aim to control valuable assets like Boardwalk and Park Place. With the game of taxes, you strategically allocate your time, money, and charitable contributions in order to take the maximal number of deductions and write-offs that are relevant to your life situation. Sound similar to you? It does to me too.

Better yet, when it comes to taxes, you’re allowed to recruit outside help in the form of accountants and certified financial planners. If only you could do that with Monopoly!

Pin Me For Later 📌:

Benefiting from Tax Deduction Examples

Don’t let your hard-earned money go to waste, when you could retain it and get it invested. By maximizing your deductions, you can save hundreds to thousands of dollars every year.

Are you interested in learning more about saving money on taxes? I’ve got you covered. Check out this article today.