|

|

Pay stubs seem like a hassle in an increasingly paperless society. If you don’t mail checks to employees, generating pay stubs can feel like a waste of time during your payroll process.

You might have plenty of reasons not to deal with pay stubs. However, businesses small and large should consider these important financial documents. It’s easy to become unorganized and lose track of an employee’s details without a reliable way to generate paycheck stubs.

Why should your company create check stubs? Here are three critical reasons to make it part of your regular payroll process.

1. Itemization and Accountability

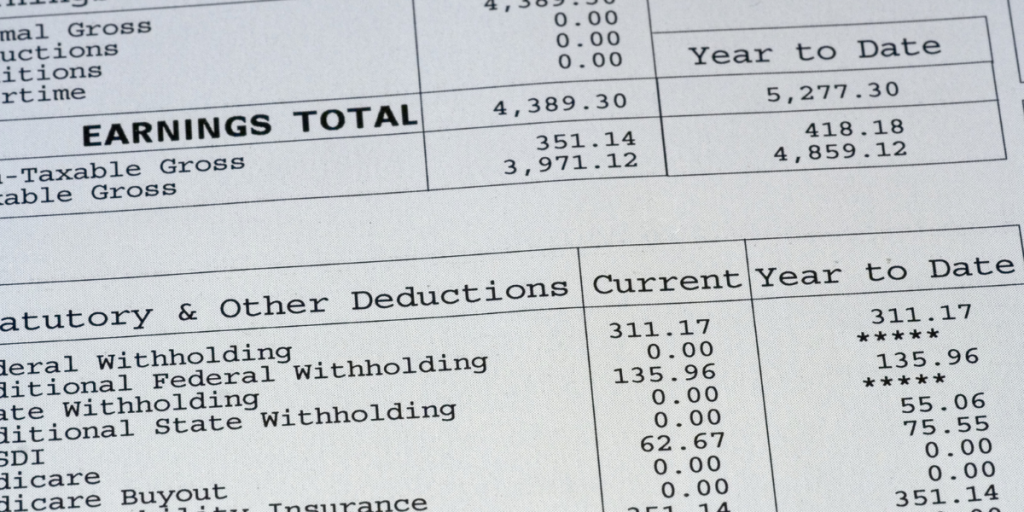

The easiest way for employees to track their year-to-date earnings, paid time off, and tax deductions is to place all of that information on pay stubs. Companies that make that information readily available when staff receive their payments can reduce the volume of questions and confusion about these important itemizations.

While an employee might not review that information every time they receive their paycheck, they know the details are always there. Plus, your payroll personnel can easily use this tool to double-check an employee’s tax rates and accrued time off.

Matching the information between an employee and the payroll team helps keep everyone accountable to accurately report pay raises or days used for vacations or sick time.

2. Reduce Errors and Save Time

Using a software system or generator to create check stubs reduces errors during payroll. You’ll also experience better accuracy when it’s time to prepare annual business taxes.

Instead of handwriting ledgers and paychecks, payroll is a more straightforward data entry process. Human error is inevitable when your business relies on a manual employee paycheck process. Generating payments from information saved in a secure system reduces the potential for mistakes.

With a database and the right software solution, the accuracy of paychecks and itemizations improves! When it’s time to prepare taxes, all payroll information is stored in the system and accurate. In case of an audit, the right pay stub system makes it easier to reference details and documentation from any point during the year.

Fewer Errors Save Time

Your payroll department becomes more efficient, too! Paystub generators make the payroll process quicker and more accurate. Instead of taking days to prepare payroll for every pay period, your accounting team can process this task more quickly. There’s no need to spend time fixing errors and redoing paychecks that can happen with a manual process.

3. Support Employees

Your employees also benefit from pay stubs. Renting an apartment, buying a home, processing year-end taxes, and qualifying for loans need income verification. With a readily-available paystub, you give employees what they need to handle common life situations.

Create Check Stubs to Improve Your Business

Producing paystubs doesn’t require mountains of paper anymore. Maintain paperless office operations when you create check stubs electronically. Save time, improve accuracy and efficiency, boost accountability, and maximize your resources, with the right paycheck generating service.

Was this information helpful? We hope you’ll browse more of our blogs.