|

|

The United States has a GEI or Global Entrepreneurship Index rating of 83.6. This means it has the best climate for new business owners in the world.

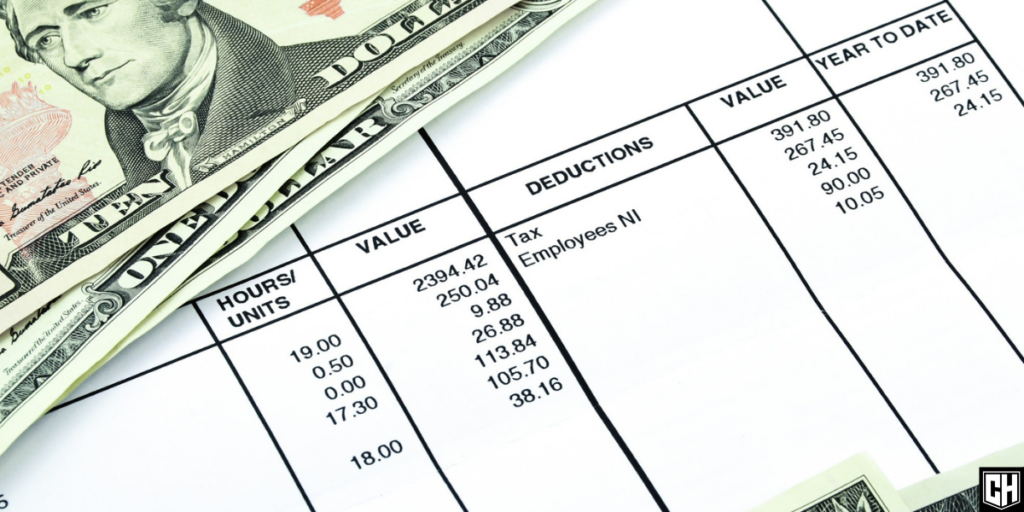

The payroll process is one of the most difficult and underrated parts of managing a business. You need to know how many hours your employees work, how much to pay them, and what to withhold.

Creating a pay stub for each employee makes the process easier. They’re required by law and important for record-keeping, but making them yourself can be complicated. Online services make it easier.

Read our guide to learn how to make a pay stub online and handle the payroll process on your own.

How to Do Payroll

20% of U.S. employers have at least 20 employees. Each one requires an accurate pay stub and adds to the burden of managing business taxes.

Accurate payroll management ensures that you meet requirements in your state and give every employee exactly what they’ve earned. It’s complex but can be completed on your own without hiring a professional.

The payroll process includes three stages; pre-payment, payment, and post-payment.

Pre-payment is where you plan for how and when to pay your employees. Paperwork you may need in this stage includes application forms, I-9 forms to prove each employee’s eligibility to work in the U.S., an IRS-W4 form to keep track of withholdings, and other state and local tax withholding documents.

The payment stage is where you must calculate how many hours each employee has worked and how much you’ll need to pay them. Pay stubs are essential paperwork in this stage.

The post-payment stage involves sending records of your payroll process to the IRS. You may have to make payroll tax deposits using a Form 8109, quarterly reports with a Form 941, and/or annual unemployment tax reports with a Form 940. You should also use a payroll register and tax calendar to create your own records.

How to Make Pay Stubs

Calculating payroll taxes involves considering your taxable workers and wages and calculating withholdings.

Taxable wages include salaries, bonuses, and gifts.

States require employers to issue a pay stub to each employee. It can be included with their paycheck or sent to them to notify them of payments through direct deposit.

Each paystub must include:

- Company name and address

- Employee name and address

- Pay period

- Check number

- Bank information

- Gross and net salary

- Regular hours and pay rate

- Overtime hours and pay rate

- Mandatory and voluntary deductions

- Date of payment

- Employee signature

To calculate an employee’s gross pay, use the hours they’ve worked and the hourly rate or total for the pay period.

When deciding how much to withhold, start with federal and state taxes. Next, take 12.4% for Social Security, 2.9% for Medicare, and 6.0% for unemployment taxes

After you’ve done these calculations, you can begin to make pay stubs.

Where to Make a Pay Stub Online

Several services allow you to create pay stubs online. They may complete calculations for you and provide other helpful features.

Choosing the right pay stub generator makes the entire payroll process easier. Check here to find the best way to create check stubs online.

If you’re one of the many entrepreneurs in the U.S., you now know how to complete the payroll process. Creating a pay stub for each employee will be a critical part of hiring and scaling your team.

Of course, payroll is only the beginning of running a business. Interested to learn more? Join a half million other readers or connect with Cade on Instagram.