|

|

Real estate syndication is when a group of people pool their money together to purchase real estate assets.

Typically, there is the real estate syndicator (or sponsor). This person or group identifies the properties to acquire, presents them to the investors, and collects the capital needed to close on the properties.

In contrast, investors contribute capital in exchange for an ownership stake in the property or properties. The investors do not participate in the day-to-day operations of the assets and their financial downside is limited to the amount of money that they invest.

If you’re interested in financial independence, then you’ve got to be acquiring passive flows of income as well as active flows of income.

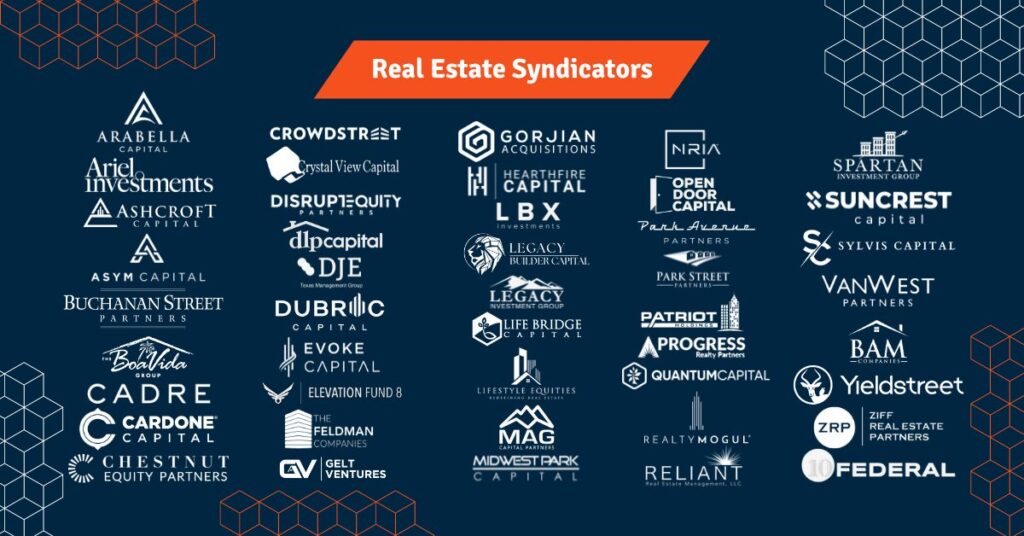

With that said, if you want to reap the benefits of owning real estate without the headaches or hassles of direct ownership, here is a master list of real estate syndicators who offer passive investment opportunities.

List of Real Estate Syndicators

The real estate syndicators below are listed in alphabetical order:

- Ariel Investment Management (aerialinvestmentmanagement.com) – Invests in manufactured housing communities, self storage, and apartment buildings.

- Arabella Capital (arabellacapital.com) – Invests in single family build-to-rent properties.

- Ashcroft Capital (ashcroftcapital.com) – Invests in apartments (multi-famil) in Sunbelt markets.

- Asym Capital (symcapital.com) – Asym’s principle, Hunter Thompson, invests in in mobile home parks, shopping centers, self-storage, and multi-family apartments.

- Buchannan Street Partners, L.P. (buchananstreet.com) – Invests in office, industrial, retail, multifamily, and self-storage properties in the Western U.S.

- BoaVida Group (theboavidagroup.com) – Invests in manufactured housing communities and RV parks.

- Cadre (cadre.com) – Invests in multifamily, industrial, office, and hotel properties.

- Cardone Capital (cardonecapital.com) – Invests in apartments (multi-family properties).

- Chestnut Equity Partners (chestnut.global) – Invests in commercial real estate assets.

- COARE, Creating Opportunities in Affordable Real-Estate (coarecommunities.com) – Invests in manufactured housing communities.

- Crowdstreet (crowdstreet.com) – Invests in various types of commercial real estate.

- Crystal View Capital (crystalviewcapital.com) – Invests in mobile home communities and self-storage investments.

- Disrupt Equity (disruptequity.com) – Invests in multifamily properties (apartments).

- DJE Texas (djetexas.com) – Invests in multifamily, development and land projects.

- DLP Capital (dlpcapital.com) – Offers a Building Communities debt and equity fund that invest in the ground up development, acquisition and improvement of residential real estate. Also offers a Housing Fund that invests in affordable workforce housing units.

- Dubroc Capital (dubroccapital.investnext.com) – Invests in self storage assets; is an early-stage syndicator (only a handful of properties under management).

- Elevation Fund (elevationfund.com/lp-mhc-1) – Invests in manufactured housing communities.

- Evoke Capital (evokecapital.net) – Invests in manufactured housing communities (MHCs). Lead by Pasha Esfandiary, who previously invested in multifamily properties.

- Feldman Companies (thefeldmancompanies.com) – Invests in self storage facilities.

- Fort Capital Partners (fortcapitallp.com) – Invests in industrial real estate assets.

- Gelt Ventures (gelt-ventures.com) – Invests in multi-family assets (apartments), mostly in California.

- Gorjian Acquisitions (gorjianacq.com/invest) – Invests in commercial real estate, including multifamily, retail, and and industrial properties.

- Hearthfire Capital (hfirecapital.com) – Invests in self storage facilities.

- LBX Investments (lbxinvestments.com) – Invest in retail assets, mostly neighborhood and community shopping centers.

- Legacy Builder Capital (legacybuildercapital.com) – Invests in self storage facilities.

- Legacy Investment Group (legacyinvestmentgroup.com) – Invests in self-storage, multifamily, and triple net properties throughout the Midwest.

- Lifebridge Capital (lifebridgecapital.com) – Lifebridge’s principle, Whitney Sewell, invests in multifamily properties (apartments).

- Lifestyle Equities Group (lifestyleequitiesgroup.com) – Lifestyle Equities invests in value-add residential and commercial properties across the U.S.

-

MAG Capital Partners (https://magcp.com) – MAG Capital is an invests in industrial assets.

- Midwest Park Capital (midwestparkcapital.com) – Invests in mobile home communities (MHCs)

- Monarch Investment and Management Group (mimginvestment.com) – Invests in income-producing real estate, particularly multifamily apartment communities.

- NRIA (nria.net/invest) – Invests in luxury townhomes and condominiums, as well as apartment acquisition and development.

- Open Door Capital (odcfund.com) – Open Door is an investment fund led by Brandon Turner, VP of Growth at Bigger Pockets. It invests in manufactured housing communities.

- Park Avenue Partners (parkavenuepartners.com) – Invests in mobile home communities (MHCs)

- Park Street Partners (parkstreetpartners.com/fund) – Invests in manufactured housing communities.

- PassiveInvesting.com (passiveinvesting.com) – Invests in commercial real estate assets, with a focus on multifamily, self-storage, hotel, and car wash investments.

- Patriot Holdings (patriotholdings.com) – Invests in mobile home communities, self storage, and industrial assets.*

- Progress Realty Partners (PRP.us) – Invests in retail and industrial properties.

- QC Capital Group (qccapitalgroup.com)- Invests in multifamily real estate, as well as car washes.

- Quantum Capital (https://quantumcapitalinc.com) – Invests in value-add multifamily assets.

- Realty Mogul (realtymogul.com/investment-

opportunities) – Invests in apartments. - Reliant Real Estate

Management, LLC (reliant-mgmt.com) – Invests in self storage facilities. - Spartan Investment Group (spartan-investors.com) – Invests in self-storage facilities through its FreeUp Storage Fund focused on the Dallas-Fort Worth area.

- Stonecutter Capital Management (stonecuttercapital.com) – Invests in multifamily assets.

- Suncrest Capital (suncrestcap.com) – Invests in manufactured housing communities.

- Sylis Capital (sylviscapital.com) – Invests in multi-family real estate (apartments).

- The Bam Companies (capital.

thebamcompanies.com) – Invest in multifamily properties (apartments). - Van West Partners Fund (vanwestpartners.com) – Invests in self storage facilities.

- YieldStreet (yieldstreet.com) – Invests in commercial real estate, art, and other types of alternative investments.

- Ziff Real Estate (ZRP) Partners (ziffcre.com/investing) – Invest in self-storage assets.

- 10 Federal (10federal.com) – Invests in self storage facilities.

Want to view this Master List of Real Estate Syndicators as a PDF? Click here to download it.

Who else should be added? Mention them in comments or send your suggestions to us here.

*Disclaimer: Before making any financial decisions, you should consult with professional adviser, such as a financial planner or CPA.